MU | Century Financial Limited

Trade Commodities

Invest in some of the world’s most sought -after commodities, including gold, silver, crude oil, and more.

Trade Commodities

Gold Trading (XAU/USD)

Gold is one of the most traded commodities worldwide, acting as a safe-haven asset during market volatility.

- Hedge Against Inflation & Economic Uncertainty

- High Liquidity & 24/5 Market Access

- Tight Spreads & Transparent Pricing

- Trade on Century Trader App & MT5

Silver Trading (XAG/USD

Silver is a high-demand industrial metal, often showing greater price volatility than gold, creating opportunities for traders.

- Popular for Both Investment & Industrial Use

- Greater Volatility & Trading Opportunities

- Competitive Spreads & Fast Execution

- Popular Silver Trading Pair: XAG/USD (Silver vs. USD)

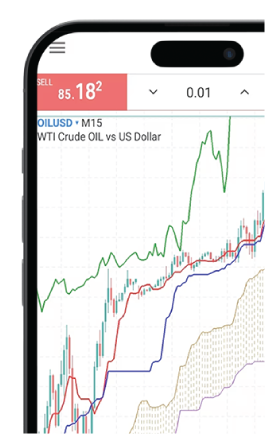

WTI Crude Oil (USOIL)

West Texas Intermediate (WTI) is a benchmark for U.S. crude oil prices, heavily influenced by global supply and demand factors.

- Highly Liquid & Actively Traded

- Volatility Creates Trading Opportunities

- Trade with Competitive Spreads & Leverage

- Popular Trading Pair: USOIL/USD (WTI Crude vs. USD)

Brent Crude Oil (UKOIL)

Brent Crude is the global benchmark for oil prices, used to price two-thirds of the world’s crude supply.

- Global Oil Benchmark for Price Movements

- Impact of Geopolitical & Supply Chain Factors

- Deep Liquidity & High Trading Volume

- Popular Trading Pair: UKOIL/USD (Brent Crude vs. USD)

Top 10 Most Traded Commodities Worldwide

Commodities are fundamental to the global economy, serving as the raw materials for various industries and daily life. Understanding their market dynamics is crucial for investors and businesses alike. Below is an overview of the top 10 most traded commodities, including their current prices, 52-week highs and lows, and key factors influencing their prices.

| Commodity | Current Price | 52-Week High | 52-Week Low | Factors Influencing Price |

|---|---|---|---|---|

| Brent Crude Oil | $70.65 | $92.18 | $68.33 | Supply-demand dynamics, geopolitical tensions, OPEC+ production decisions, global economic growth, and currency fluctuations. |

| WTI Crude Oil | $67.19 | $87.67 | $65.22 | Similar to Brent Crude, influenced by U.S. shale production levels, domestic policies, and inventory data. |

| Gold | $2,990.00 | $3,004.80 | $2,146.20 | Investor demand during economic uncertainty, inflation rates, currency movements, and geopolitical events. |

| Silver | $34.11 | $34.84 | $24.43 | Industrial demand, particularly in electronics and solar energy, currency strength, and economic indicators. |

| Copper | $4.86 | $5.20 | $3.92 | Global industrial activity, especially in construction and manufacturing, supply disruptions, and inventories. |

| Natural Gas | $4.09 | $4.90 | $1.48 | Seasonal weather patterns, storage levels, production rates, and geopolitical events affecting supply routes. |

| Coffee (Arabica) | $390.60 | $440.85 | $179.35 | Weather conditions in key growing regions, pest infestations, and changes in consumer demand. |

| Soybeans | $1,017.00 | $1,258.25 | $936.25 | Global demand, particularly from China, weather impacts on yields, and biofuel industry demand. |

| Cocoa | $6,067.00 | $10,265.00 | $4,842.00 | Weather conditions, political stability in producing countries, and global demand for chocolate products. |

| Corn | $458.75 | $504.50 | $360.50 | Ethanol production demand, livestock feed requirements, and crop yield forecasts. |

Above table is updated as of 28th Feb 2025*

Why choose Century Financial for online trading?

Regulated by FSC

Century Financial is regulated by the Financial Services Commission (FSC) Mauritius,

ensuring a secure and compliant trading environment.

100+ Industry awards

Trade with a broker that has been

repeatedly recognised for the quality of its services.

Low Costs and Competitive Spreads

Enjoy zero hidden fees, low commission, and ultra-tight spreads on major markets.

Trade with transparency and efficiency.

Cutting-Edge Trading Technology

Trade CFDs on Forex, Stocks, Indices, Metals, Energies, ETFs, and Crypto with our advanced

trading platforms—Century Trader App (Web & Mobile) and MetaQuotes 5 (MT5).

Enhanced insurance upto US$ 1M per client

Trade with confidence, and receive additional protection for your funds, with comprehensive insurance coverage of up to US$1 million per client, in the unlikely event that we become insolvent.

24/5 Dedicated Customer Support

Our customer support team are available 24 hours a day, five days a week to assist you.

Choose Your Forex Trading Platform

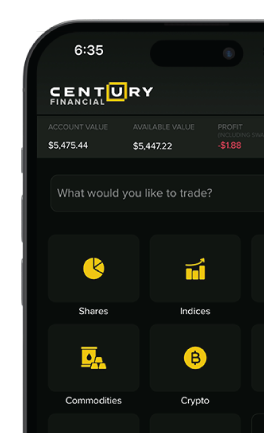

Century Trader App

(Web & Mobile)

- Real-time price updates & market insights

- Advanced charting tools & risk management features

- Seamless execution across all devices

MetaQuotes 5

(MT5)

- Customizable technical indicators & trading algorithms

- Market depth & one-click execution

- Ideal for both beginner & advanced traders

How to Start Trading Commodities with Century Financial

Sign Up

Create your account with a few simple steps.

Fund Your Account

Secure deposits with multiple funding options.

Choose your trading platform

Century Trader App or MT5.

Start trading Forex

Choose from major minor or exotic pairs.

FAQ

What is commodity trading, and how does it work?

Commodity trading involves speculating on the price movements of raw materials, such as gold, silver, crude oil, and agricultural products. Traders can buy or sell commodities as CFDs without owning the physical asset.

Which commodities are the most popular for trading?

Some of the most actively traded commodities include:

- Gold (XAU/USD) – Safe-haven asset

- Silver (XAG/USD) – High-volatility industrial metal

- WTI Crude Oil (USOIL/USD) – U.S. oil benchmark

- Brent Crude Oil (UKOIL/USD) – Global oil benchmark

- Natural Gas (XNG/USD) – Energy market volatility

How do I start trading commodities with Century Financial?

- Sign up and verify your account

- Deposit funds securely

- Choose your trading platform (Century Trader App or MT5)

- Start trading commodities