Why Q2 2025 is all about

U.S. vs Europe:

Market Rotation Explained

Introduction:

Q2 2025 has been nothing short of a spectacle for global markets. U.S. stocks have taken center stage, soaring to new highs while their European counterparts have stumbled. As investors and analysts scramble to decode the divergence, one theme rings loud and clear: market rotation. Understanding this shift isn’t just about tracking performance — it’s about uncovering trading opportunities that could define the rest of the year.

What is Market Rotation?

Market rotation refers to the movement of capital from one sector, asset class, or region to another. It’s a recurring phenomenon, driven by changing economic conditions, interest rates, earnings outlooks, and geopolitical factors.

In 2025, this rotation is playing out vividly between U.S. and European stocks. While the S&P 500 is reaching record highs, led by megacap tech and AI-driven sectors, indices like the Euro Stoxx 50 are underperforming, dragged by weak growth and policy uncertainty.

Q2 2025: U.S. Stocks Outperform, Europe Falls Behind

U.S. Snapshot:

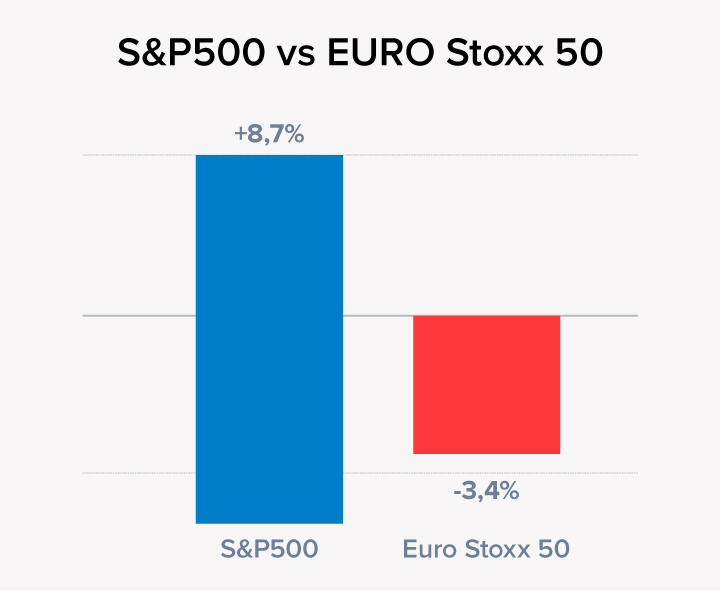

The S&P 500 is up 8.7% quarter-to-date, powered by a rebound in earnings and investor confidence.

Nasdaq Composite has surged 12%, with AI and semiconductor stocks like Nvidia and AMD leading the charge.

U.S. GDP for Q1 was revised upward to 2.6%, defying earlier recession fears.

European Snapshot:

The Euro Stoxx 50 is down 3.4% in Q2, weighed by sluggish industrial output and Germany’s economic stagnation.

The ECB has cut interest rates once in 2025, but dovish policy has done little to lift equity sentiment.

PMI data remains below 50 in major economies like France and Italy, signaling contraction.

Key Drivers Behind the Divergence

Macroeconomic Resilience in the U.S

Despite rate headwinds, the U.S. economy remains resilient. Consumer spending and job growth remain steady, fueling earnings growth and investor optimism.

AI and Tech-Led Rally

The U.S. continues to dominate the AI innovation curve. From Microsoft to Tesla, tech stocks are drawing global capital. European markets lack similar tech breadth, making them less attractive in this rotation.

Policy and Fiscal Support

The U.S. government’s 2025 fiscal package, including renewed infrastructure spending and energy incentives, has acted as a stimulus. Europe, in contrast, is dealing with fiscal tightening and political uncertainty, especially in Germany and France.

Currency Advantage

A relatively stronger euro has hurt export-heavy European companies, while a mild U.S. dollar decline has helped multinational American firms.

What This Means for Traders:

Opportunities in Rotation

Index Rotation:

Traders eyeing short-term gains are shifting positions from European ETFs into U.S.-focused indices like the S&P 500 and Nasdaq 100.

Sector Rotation:

While Europe leans heavily on banks and industrials, the U.S. offers growth in AI, green energy, and tech—ideal for momentum strategies.

Long/Short Strategies:

Traders are deploying long positions in high-performing U.S. sectors and shorting lagging European equities for alpha generation.

Currency Hedging:

With EUR/USD volatility rising, smart traders are pairing equity positions with forex hedges to reduce currency risk.

Conclusion

Q2 2025 is shaping up as a masterclass in market rotation, and the U.S. vs Europe divergence is a prime example. With U.S. stocks racing ahead on innovation and growth, and European equities faltering amid structural drags, investors must reassess their global exposure. Whether you’re a passive index holder or an active trader, recognizing these regional shifts can be the key to staying ahead of the curve in 2025.